ALTON – Jeffery Anderson recently became the director of the Office of Health Reform at the Department of Health and Human Services, after having formerly served at the 2017 Project and at the Hudson Institute.

ALTON – Jeffery Anderson recently became the director of the Office of Health Reform at the Department of Health and Human Services, after having formerly served at the 2017 Project and at the Hudson Institute.

He favors free-market health care reform. His pivotal position should encourage anyone interested in market solutions to health care reform, particularly in view of the paucity of information in the major media. This article will summarize his views as expressed in his blog “An Alternative to ObamaCare” (https://www.hudson.org/research/12004-an-alternative-to-obamacare).

Flaws in ObamaCare that have exacerbated the high cost of health care are expensive exchange subsidies, the huge cost of Medicaid expansion, unwise regulations that curtail the choices of private citizens, and the unprecedented individual mandate to purchase health insurance.

He believes a “well-conceived alternative to ObamaCare” should decrease costs, restore liberty, and assure that any American who wants to buy health insurance can do so. He favors: (1) TAX CREDITS for the uninsured and individually insured; (2) mitigation of expensive PREEXISTING CONDITIONS; and (3) LOWERING HEALTH CARE COSTS across the board.

TAX CREDITS: The federal government instituted a wage and price freeze during World War II to avoid chaos in the labor market, but also allowed large businesses and labor unions to negotiate on the basis of fringe benefits, especially health insurance. This caused an unfair tax disparity between employees of large companies, small business employees and individual policy owners.

Eliminating all tax breaks would be politically unfeasible. Allowing tax credits for all might be hard to legislate. Allowing tax credits for insurance for individuals and small businesses would be a fair compromise. However, large businesses and their employees might prefer tax credits, rather than the expense and hassle of employer-sponsored insurance, because the deductions would not only be on income but on Medicare and Social Security. This leaves choices for both employer and employee.

PREEXISTING CONDITIONS: ObamaCare uses mandates to address preexisting conditions. This is a bad plan. It causes dramatic escalation of insurance costs. People wait until they have an illness to purchase insurance, which only compounds the problem. Insurance actuaries cannot accurately predict risk under these conditions. Fiduciary responsibility requires that they keep the premiums high enough to protect the insurance company from bankruptcy due to unpredictable, high outlays for high-risk patients.

Anderson feels “no one should be dropped from their existing health insurance or have their premiums….increased, on the basis of a health condition”.

He also favors a buy-in-period for young adults and for those who lose their employer-sponsored insurance and must buy individual coverage. During that period, they would buy insurance at the standard rate for their age. He suggests that insurance should follow the employee for at least one year if they have worked for the first employer for at least one year. The same employment time limitation would apply to those who lose their insurance.

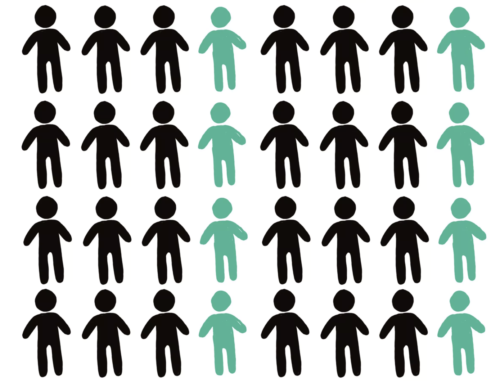

The last recommendation, also supported by several other experts in the field, would be funded by a $7.5 billion federal allotment to the states for the establishment and maintenance of state-run, high-risk pools. Individual contributions to the premiums would be capped at 150% to 250%.

LOWERING HEALTH CARE COSTS across the board: Tax credits for those in the general insurance market could have multiple benefits. Tax credits could be offered to buyers of HSA plans, when they buy or if they already own a plan, for which they did not receive a tax credit. This one-time tax credit would be $1,000 for an individual, $2,000 for a couple, or $4,000 for a family of four.

These and similar ideas are shared by numerous economists and scholars but are not reaching the public’s attention. They indicate that the present Department of HHS would support advocates of market solutions in health care reform.

However, without Congressional action, these advances could be reversed at the whim of a future administration.

Robert F. Hamilton, M.D., FACS